Legislative proposal to Parliament: Third application round for business cost support in April to include sole entrepreneurs

The objective of business cost support is to help companies in the difficult economic situation caused by the coronavirus. The Government is now proposing amendments to the Act on Support for Business Costs, which would make it possible to grant aid more flexibly, especially to sole entrepreneurs and small enterprises.

The Government submitted its legislative proposal to Parliament on 4 March 2021. After Parliament’s consideration, the President of the Republic will approve the Act. Consequently, the State Treasury could start accepting applications from companies and sole entrepreneurs at the end of April. The basic conditions of the aid will remain unchanged.

“As a matter of urgency, the Ministry of Economic Affairs and Employment is preparing a support model for the reasonable compensation of businesses affected by the new closure announced in March. The Government’s proposal on a third application round of business cost support applies to business activities before this closure in March,” says Minister of Economic Affairs Mika Lintilä.

The Act on Support for Business Costs may be amended as a result of the reasonable compensation provided to businesses affected by the closure. The amendments will be submitted either as a supplementary Government proposal during the Parliamentary committee discussions or as a separate proposal, depending on the progress of the preparation.

Fall in turnover is a condition for receiving business cost support

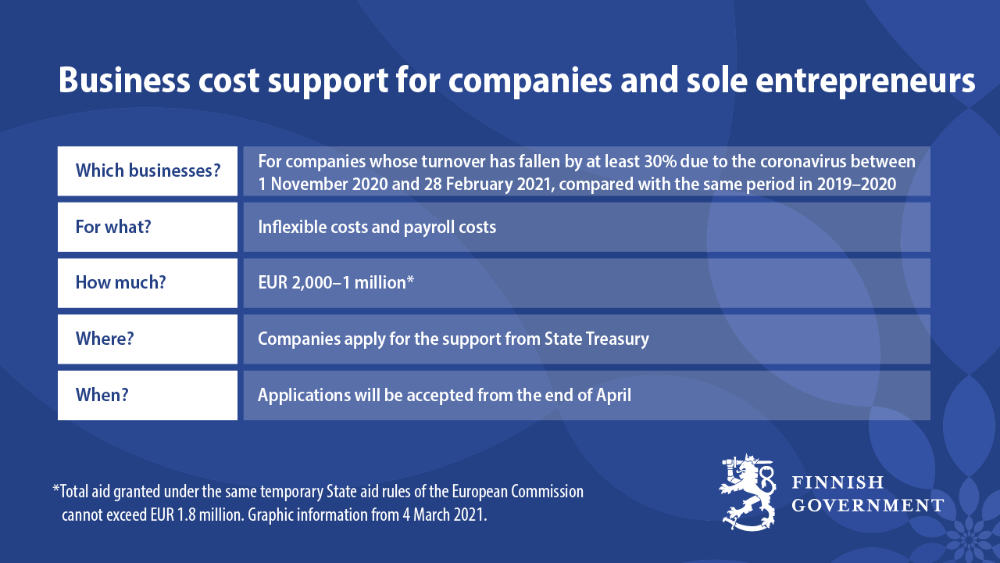

The third round of business cost support is intended for companies whose turnover has fallen by more than 30% due to the coronavirus pandemic between 1 November 2020 and 28 February 2021, compared with the corresponding period in 2019–2020.

All companies can apply for business cost support. The Government will later issue a decree on the sectors that can apply for support without providing further justification. If a company does not operate in one of the sectors defined in the decree, it must justify the need for support and provide an account of the loss of turnover due to COVID-19. The decree will include the sectors where turnover has decreased by at least 10% during the period.

The definition of inflexible costs which support can be applied for has been specified. In addition, the employer’s non-wage labour costs, such as social security contributions and occupational health expenses, would be accepted as costs, calculated as a percentage of the payroll costs over the support period.

Sole entrepreneurs to apply for support at State Treasury

Support for sole entrepreneurs will be part of the business cost support. Municipalities will not organise a separate application round of support for sole entrepreneurs.

A minimum support of EUR 2,000 will be paid to sole entrepreneurs if they meet the conditions for it. The amount of support will be based on the decrease in the company’s turnover and actual costs.

To be eligible for business cost support, the company must have a Business ID. The company must also have eligible expenses of at least EUR 2,000 during the support period. As before, there will be no lower limit on the turnover of the company.

Previously, sole entrepreneurs and small enterprises were able to apply for business cost support, but no aid was granted to companies where the support would have amounted to less than EUR 2,000.

Maximum amount of aid to rise to EUR 1 million

The maximum amount of aid will increase and thereby meet the needs of large companies in particular. The maximum amount of aid a company can receive will rise from EUR 500,000 to EUR 1 million.

The aid already granted will be taken into account in the amount of the business cost support so that the total aid granted under the same temporary State aid rules of the European Commission will not exceed EUR 1.8 million. The ceiling was previously EUR 800,000. The new maximum amount is based on the Commission’s decision to raise the company-specific ceilings for aid.

Business cost support is a way to help entrepreneurs during the coronavirus crisis

The business cost support is direct financial aid to companies, which does not need to be paid back. As before, the support is compensation for the company’s inflexible costs and payroll costs, but it does not compensate for a fall in turnover. The first application round for business cost support took place in July–August 2020. The second round began in December 2020 and ended in February 2021. The budget for the third application round is EUR 380 million.

Support for business costs is one way for the Government to help companies during the coronavirus situation. With the help of previous support from Business Finland and ELY Centres, companies were able to develop and redirect their operations in the coronavirus situation. Other forms of support include Business Finland’s research, development and innovation loans, Finnvera’s guarantees and the financing programmes of Finnish Industry Investment Ltd, where applications are still accepted. The Government also proposes that the right of entrepreneurs to receive labour market support continue due to the coronavirus pandemic. Other previous forms of aid include special support for the food and beverage services sector and sole entrepreneurs.

Inquiries:

Jenny Hasu, Special Adviser to the Minister of Economic Affairs, tel. +358 295 047 213

Sampsa Nissinen, Senior Ministerial Adviser, Ministry of Economic Affairs and Employment, tel. +358 29 504 7189

Maija Lönnqvist, Chief Specialist, Ministry of Economic Affairs and Employment, tel. +358 50 331 3791

.png/72af36e9-d29d-39f8-90e8-e9c05b60e32b?t=1615272220194&imagePreview=1)

Questions and answers on support for business costs

State Treasury website: third application round

Information on company financing during the coronavirus situation https://tem.fi/tilannetietoa-yritysrahoituksesta-koronatilanteessa (in Finnish)